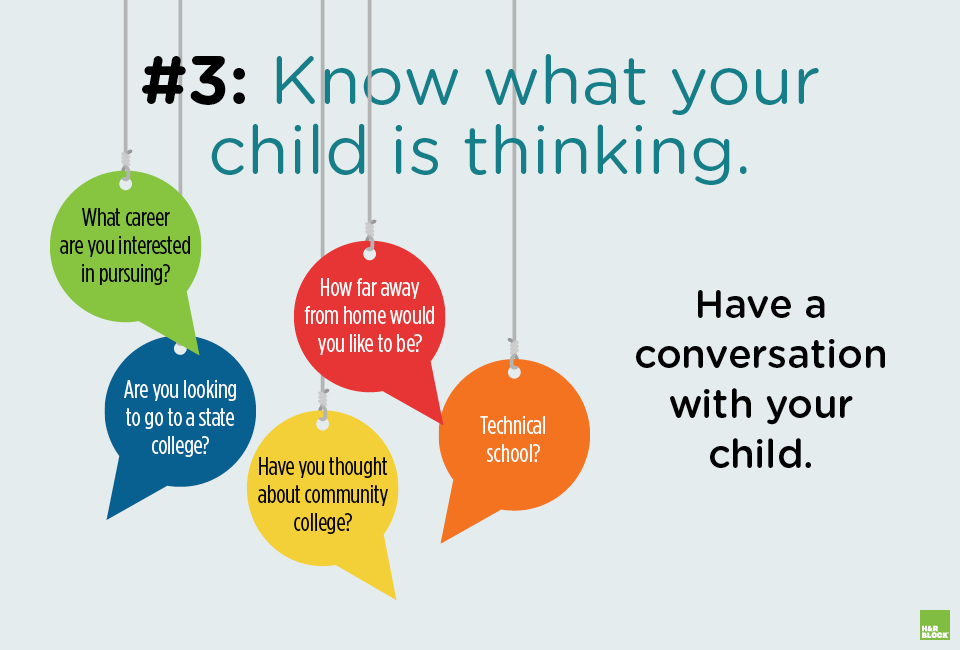

Encourage Your Youngster's Desires: Discover the most effective Ways to Save for College

Achieving Financial Success in College: Practical Preparation Tips for Pupils

As tuition prices proceed to climb and living expenses include up, it is important for students to develop sensible preparation methods to attain monetary success during their university years. From setting economic objectives to taking care of pupil car loans, there are numerous steps that students can take to guarantee they are on the ideal track towards a stable financial future.

Setup Financial Goals

When establishing monetary objectives, it is important to be specific and sensible. Rather than simply aiming to conserve cash, established a specific amount that you wish to conserve monthly or term. This will certainly provide you a clear target to work towards and make it simpler to track your development. Furthermore, make certain your goals are achievable and realistic within your current financial situation. Establishing castle in the airs can result in irritation and prevent you from remaining to work towards financial success.

In addition, it is very important to prioritize your economic objectives. Identify what is crucial to you and concentrate on those objectives initially. Whether it is repaying trainee fundings, saving for future expenditures, or developing a reserve, comprehending your priorities will certainly help you allot your resources effectively.

Developing a Budget

This might consist of cash from a part-time task, scholarships, or financial help. It is essential to be complete and reasonable when approximating your costs.

Once you have recognized your earnings and expenses, you can allot your funds appropriately. Think about alloting a portion of your revenue for emergencies and financial savings. This will help you develop a safeguard for future goals and unforeseen costs.

Evaluation your budget consistently and make modifications as required. This will certainly ensure that your spending plan remains practical and efficient. Tracking your expenses and comparing them to your spending plan will assist you determine areas where you can reduce back or make renovations.

Producing a spending plan is an essential tool for economic success in university. It allows you to take control of your funds, make informed decisions, and job towards your economic objectives.

Optimizing Scholarships and Grants

Making the most of grants and scholarships can dramatically reduce the monetary problem of university expenses. Grants and scholarships are types of monetary help that do not require to be repaid, making them an ideal method for pupils to money their education and learning. With the rising cost of tuition and fees, it is important for trainees to optimize their opportunities for scholarships and gives.

One method to maximize gives and scholarships is to begin the search early. Numerous organizations and institutions provide scholarships and grants to students, yet the application deadlines can be months in advance. By starting early, pupils can apply and look into for as lots of possibilities as feasible.

Furthermore, students must completely check out the qualification needs for each scholarship and give. Some might have certain criteria, such as scholastic success, area participation, or specific majors. By recognizing the imp source requirements, students can customize their applications to highlight their toughness and boost their possibilities of receiving financing.

In addition, pupils must consider using for both national and local scholarships and gives. Local scholarships usually have less candidates, enhancing the likelihood of obtaining an award. National scholarships, on the various other hand, might provide higher financial value. By expanding their applications, students can optimize their possibilities of securing financial assistance (Save for College).

Managing Trainee Lendings

One critical aspect of browsing the economic obligations of university is efficiently handling pupil fundings. With the climbing cost of tuition and living costs, several students depend on loans to money their education. Mismanaging these lendings can lead to lasting monetary problems. To prevent this, students should take a number of steps to properly manage their student fundings.

Primarily, it is crucial to comprehend the terms of the finance. This consists of recognizing the passion price, payment period, and any potential fees or penalties. By understanding these information, trainees can prepare their finances accordingly and stay clear of any kind of shocks in the future.

Producing a budget is an additional crucial action in taking care of trainee fundings. By tracking income and expenses, pupils can make certain that they allot sufficient funds towards loan settlement. This also aids in determining areas where expenditures can be minimized, enabling more cash to be guided towards financing settlement.

Additionally, trainees ought to discover choices for lending mercy or repayment support programs. These programs can provide alleviation for customers that are having a hard time to settle their finances. It is necessary to research and understand the qualification criteria and demands of these programs to take full benefit of them.

Finally, it is crucial to make prompt loan repayments. Missing or delaying settlements can result in added fees, charges, and adverse effect on credit report. Setting up automatic settlements or tips can aid guarantee that repayments are made on time.

Conserving and Spending Methods

Browsing the financial obligations of university, consisting of efficiently taking care of pupil fundings, establishes the structure for students to carry out conserving and investing strategies for long-lasting monetary success.

Conserving and spending approaches are vital for university pupils to safeguard their economic future. While it might appear daunting to start investing and saving while still in university, it is never prematurely to begin. By executing these methods early, pupils can take benefit of the power of substance passion and go to website construct a strong economic structure.

Among the primary steps in investing and saving is creating a budget. This allows students to track their revenue and expenditures, recognize locations where they can reduce, and allot funds in the direction of financial savings and financial investments. It is crucial to set particular financial objectives and develop a plan to achieve them.

Another technique is to establish an emergency fund. This fund functions as a safety net for unexpected expenses or emergency situations, such as clinical costs or car repairs. By having an emergency fund, students can avoid going into debt and maintain their economic stability.

Conclusion

In final thought, by establishing financial objectives, developing a budget, maximizing scholarships and grants, handling pupil fundings, and applying saving and investing techniques, university pupils can achieve monetary success throughout their academic years - Save for College. Embracing these sensible planning suggestions will certainly aid students develop accountable monetary behaviors and ensure a much more safe and secure future

As tuition prices proceed to rise and living expenses add up, it is critical for students to develop useful planning techniques to accomplish monetary success during their university years. From establishing monetary objectives to handling trainee finances, there are numerous steps that students can take to ensure they are on the best track towards a stable financial future.One essential element explanation of navigating the financial responsibilities of college is effectively taking care of pupil lendings. To avoid this, pupils need to take a number of steps to efficiently manage their student lendings.

Conserving and spending methods are vital for college students to secure their economic future.